One of the biggest things that real estate agents deal with every day is a large flow of information. This information can be of many types- properties, potential clients, or simply general market data. The real estate agents are always on-the-go hunting leads and opportunities to make sure they fall into their pipeline before a competitor can cash it in their pocket. Real estate funds need to be tracked properly and maintained well to ensure investors keep buying/selling their properties. Salesforce’s CRM solutions can help in unifying processes, to improve sales efficiency and productivity.

Here’s how we helped an Arizona-based real estate company when they were facing issues with their real-estate fund tracking and investor statement issues.

Goal/Problem

Real estate fund tracking poses unique challenges due to the dynamic nature of the real estate market and the financial complexities involved. One of the primary challenges is the manual nature of traditional tracking methods, which are prone to errors and can be time-consuming. Moreover, with multiple investors and diverse investment portfolios, maintaining accurate records and ensuring timely updates becomes increasingly challenging. Additionally, the need for transparency and accountability in fund management requires meticulous tracking of capital flow, fund performance, and investor returns. These challenges highlight the necessity for an automated and integrated solution that can streamline fund tracking processes, enhance data accuracy, and improve investor communication.

In our client’s case manual reporting process were the major hurdle. They wanted to automate it so that investors receive auto-generated statements on their investments when adjustments are made by the firm.

Solution

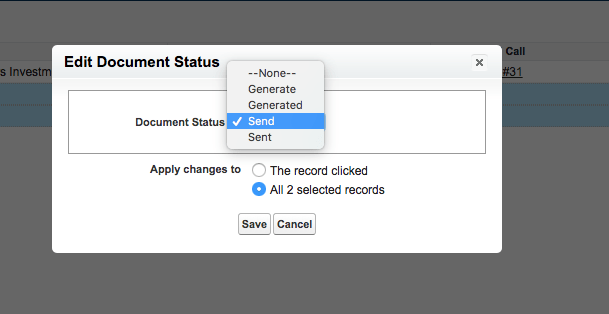

We implemented custom objects to track funds, investments, and the flow of capital in and out of funds managed by the firm. Once the transactional data is entered by the firm, they can utilize list views to mass generate and send statements to their investors with A5 Documents.

Automating the complex calculations and statement generation streamlined the process. What once took days now just takes minutes.

We specialize in automating bottlenecks like these in a simple and repeatable fashion.

In conclusion, effective real estate fund tracking is crucial for ensuring investor satisfaction, maintaining regulatory compliance, and driving business growth. Salesforce CRM offers robust solutions to address these challenges, enabling real estate firms to automate fund tracking processes, enhance transparency, and improve overall operational efficiency. By leveraging Salesforce’s customizable platform, real estate companies can streamline their fund tracking operations, mitigate risks, and focus on maximizing investor returns. Have a similar issue? Need help? Let’s connect!