Our IPs And Accelerators

Our IPs and accelerators for success empower our clients to deliver transformative experiences to their end-users.

CPQ SPYDR - Automated Testing

CPQ SPYDR is the essential accelerator for success in Salesforce CPQ testing, offering efficient and accurate automation for bundles and standalone products.

Benefits And Features

- Automates Multiple Line Verification

- Automates Bundle Configuration Testing

- Feature Verification

- Product Option Min/Max Quantities

- Bundle Pricing

- Verification of a Configuration Attributes

- Product Rule/Configuration Rules Verification

- Ability to test different types of bundles and standalone products in one script

- Ability to search pre-existing test scripts and re-run

- Easily create scripts from excel based templates

Who Needs To SPYDR Their CPQ?

Management & Stakeholders

How to mitigate risks while launching new products or during daily maintenance

Application Admins

Stable and scalable application. Zero bugs. How to ensure data accuracy and quality while migrating data and setups from one instance to another?

Product Managers/Owners

Ensure valid products and components with correct revisions and no duplicates/obsoletes

Configuration Engineers

Ensure bundles are configured as per engineering and manufacturing specifications

Pricing Managers and Discounting Groups

Profitability with maximum closed deals

QA

Test efficiently and accurately during product release

Businesses That SPYDR Their CPQ Regularly

DragNFly: A Streamlined Migration Solution

Efficiently and securely transfer data from the source to the target. Our accelerator is highly effective and trustworthy, ensuring the success of your migration.

Migration Challenges:

- Lot of manual efforts

- Lot of documentation to transfer records from one instance to another

- Finding out errors is hard and time-consuming

- Cause of errors and reasons for the error is challenging

- Maintaining accuracy is tough

What Sets DragNFly Apart?

- Detailed view of the error report in an Excel sheet

- There is no complexity in using this application as it is easy to login and logout

- Migrate a related object along with the source object

- Auto correlate CPQ object relationships

- Easy drag and drop the fields available under Map&Load tab

- No need for any third-party tool or any Excel work or documents works [templates] in this application

Migrate records from source to target in very less time with less risk and less error-prone, the application is very productive and risk-free

Easy to Install

Riskless

Secured

Easy Mapping

Drag and Drop

Less Errors

No Maintenance

How DragNFLY Can Help?

1

%

Increase in Efficiency

1

%

Reduce time in Deployment cycles in Data Migration

1

%

Improve you CPQ pricing accuracy by an additional 5-10%

Clients Benefiting Through DragNFLY

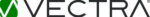

Akucast: Your Salesforce Forecasting Solution

Akucast was natively built in Salesforce as an innovative accelerator for success. It offers a streamlined forecasting process that empowers your sales team to focus on what matters most.

Benefits And Features

- Easy to adopt and user friendly

- Instill world-class pipeline management discipline to the entire sales team

- Get forecasting on auto-pilot

- Focus your Sales Ops team to do more productive work

- Easy drill-down inspection

Who Is Akucast For?

Companies That Want To Fix Forecasting

Can’t Deploy Other App

- Taking months

- High costs

- IT struggling

App Too Complicated

- Reps hate it

- Lots of training

- Too much stuff

Companies That Want To Improve Forecasting

Forecasting Manually

- Spreadsheets

- Verbal

- Emails

Native Forecasting

- Can’t Customize

- Rep’s Can’t Forecast

- Too Rigid

Clients Benefiting Through Akucast

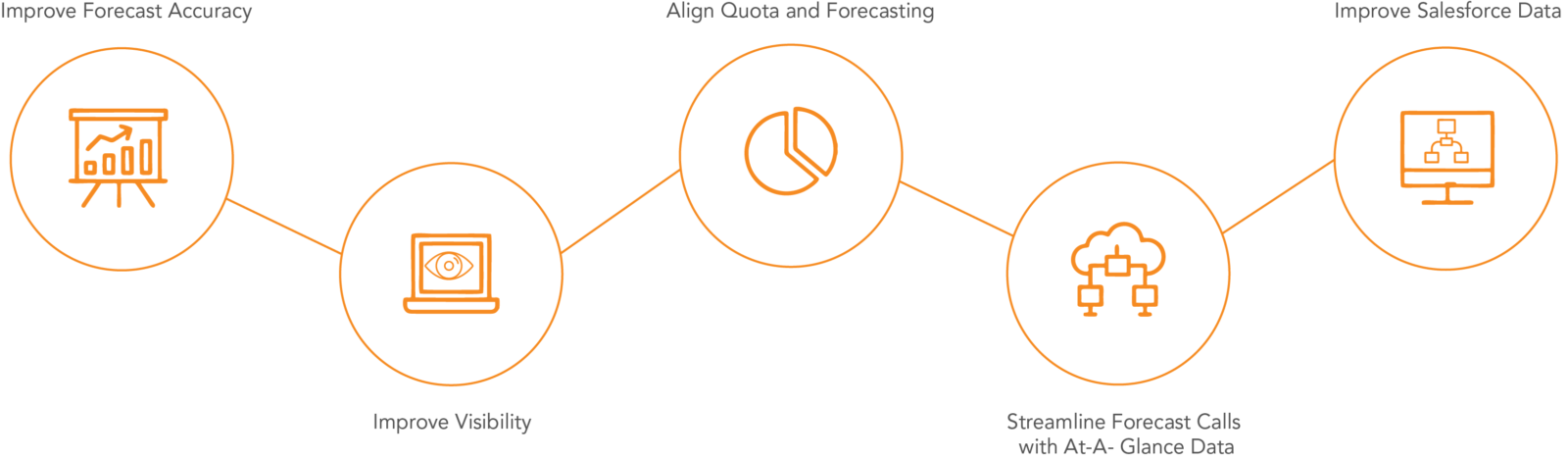

Revenue Pillars: Your Sales Performance Dashboard

Revenue Pillars is more than just a KPI tool; it’s an essential accelerator for success. Gain valuable insights into your sales trends, from new acquisitions to renewals, and make data-driven decisions to drive. growth.

Benefits And Features:

- Deal Economics

- Starting Annual Recurring Revenue (ARR)

- Delta Annual Recurring Revenue

- Ending Annual Recurring Revenue

- First Year ACV

- Total Contract Value Pillars

- New Business

- Renewal Business

- Upsell

- Expansion

- Downsell/Churn

- Recurring Revenue (RR) Pillars

- New Business (PR)

- Renewal Business (PR)

- Upsell (PR)

- Expansion (PR)

- Downsell/Churn (PR)

- Amendment and MDQ Support

- Flexible: Could be customized as needed

Adaptive Tool

Efficient Data Segregation

Measure Subscription Business

Proactive Tracking Of Customer Data

Measure And Track Sales Data

Connect To Direct Billing

How Revenue Pillars Help In Revenue Growth

- Capture recurring revenue metrics at each transaction

- Create customizable charts and reports based on your KPI

- Tie revenue pillars to billings: Track land and expand momentum

- Measure subscription business in ARR to track KPIs (renewal rates, ACV, TCV, CLV) — needed to establish a firm track record for future valuations

How Revenue Pillars Work?

Clients Benefiting Through Revenue Pillars

A5 Capital Cloud: Accelerate Your Firm's Growth

A5 Capital Cloud built on the Salesforce Platform provides turnkey solutions for firms looking to expose rapid value and create clear ROI. By leveraging A5 Capital Cloud firms can begin engaging with LP’s, tracking clear KPIs and have access to sophisticated insights within 3 weeks. A5’s industry experts will work directly with the firm’s Managing Partners to understand their investment strategy and translate their strategy into accelerator implementation requirements.

Sales And Trading

- Associate’s Day to Day View

- Active Deals by EBITDA and Industry

- Active Leads to follow up on

- Client Coverage

- Prospecting

Deal Sourcing

- Proprietary Sourcing

- Executive Network

- Deals by Engagement Type

- Weighted Revenue Month over Month

- Activity Metrics

- Received Fees by Stage

Coverage Insights

- Industries

- Geographic Regions

- Coverage Ownership

- Commitment by Tier

- Commitment by Stage

- Follow up Reminders

Marketing Cloud Campaign Intelligence

- Buyer Analytics

- Marketing Cloud Buyer Signals

- Campaign ROI

- Intelligent Lead Scoring

- Real Time Lead Activity Campaign Management

S&P Integration

- Fundraising Rounds

- Key Developments

- Direct Investments

- Subsidiaries

- Competitors

- Real Time Data Sync

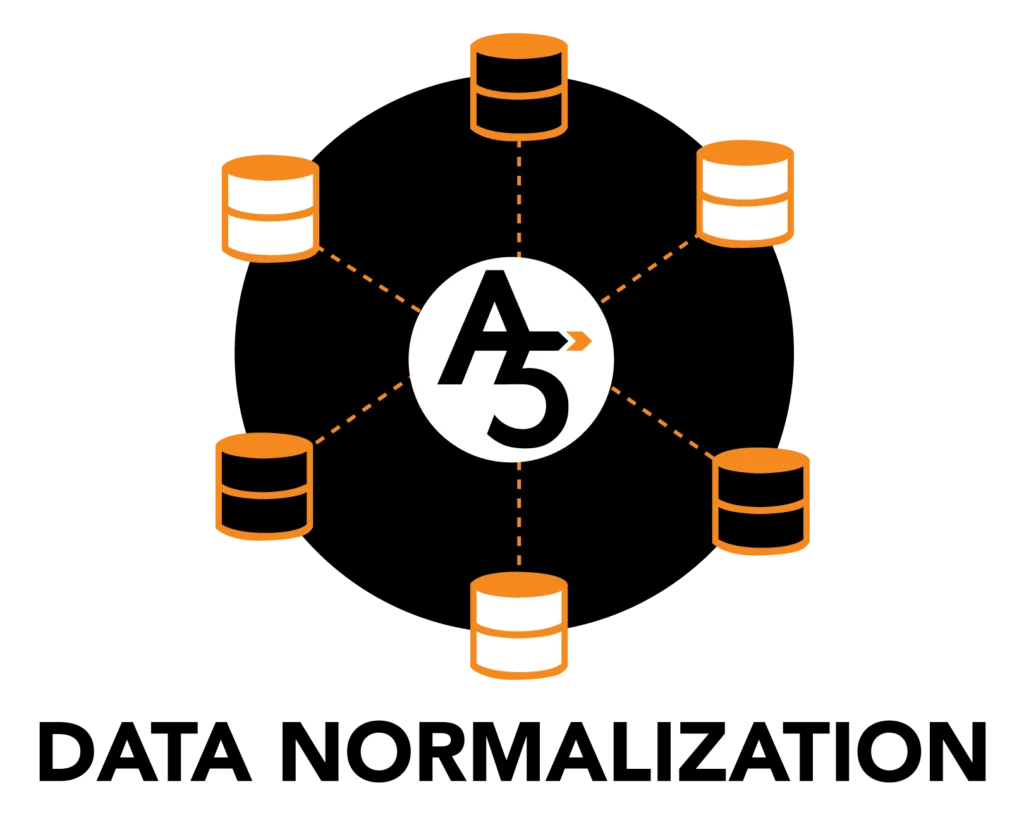

A5 Data Normalization: Clean Data, Fast Results

A5 Data Normalization is a powerful accelerator designed to enhance the accuracy, consistency, and reliability of your address data. By automating the process of data standardization and applying industry-best practices, A5 Data Normalization helps businesses streamline operations, reduce errors, and improve overall data quality.

Key Benefits:

Improved Data Accuracy

Ensure your address data is free from errors and inconsistencies.

Enhanced Operational Efficiency

Streamline processes and reduce manual data entry.

Increased Customer Satisfaction

Deliver better products and services with accurate address information.

Cost Savings

Avoid costly data-related issues and penalties.

How It Works:

Our Data Normalization accelerator applies a predefined set of standards to your address data, including:

- Separation of common phrases and characters

- Standardization of abbreviations

- Application of character limits

- Case rule enforcement

- Data compliance target analysis

Why Choose A5 Data Normalization?

- Industry-Leading Technology: Our accelerator leverages advanced algorithms and machine learning to deliver superior results.

- Tailored Solutions: We offer customizable options to meet your specific data needs.

- Expert Support: Our team of data experts is available to assist you throughout the process.