An automatic payment solution as the term suggests is a way to make the payment process fast and efficient for both merchants and their customers. With a steep growth in the number of online orders and transactions, businesses need to reduce their relevant operational costs to sustain properly. By adopting automatic payment solutions like batch payment processing and recurring billing, the business can focus on growth as well as reduce payment-related administration costs.

By definition, batch payment processing is a process of collecting a ‘batch’ of authorization requests and sending them to the payment processor for settlement. This process is normally done by merchants to retrieve their money from customers’ bank accounts.

An automatic payment solution helps to improve the customer experience, reduces operational costs, as well as helps in better operations across the organization. Here’s how a dental imaging technology company benefitted by using an automatic payment solution.

The Problem

A Dental Imaging Technology company needed an automated Quote-to-Cash solution. The previous system was very labor-intensive and forced them to keep sensitive credit card information in their Salesforce org manually charged by their Accounts Payable department. Product and Warranty orders/transactions needed to be processed separately, the former as a one-time charge and the latter as an annually recurring charge. Also, this was an international enterprise, so multiple payment gateways had to be used to process transactions based on Opportunity/Account data.

Solution

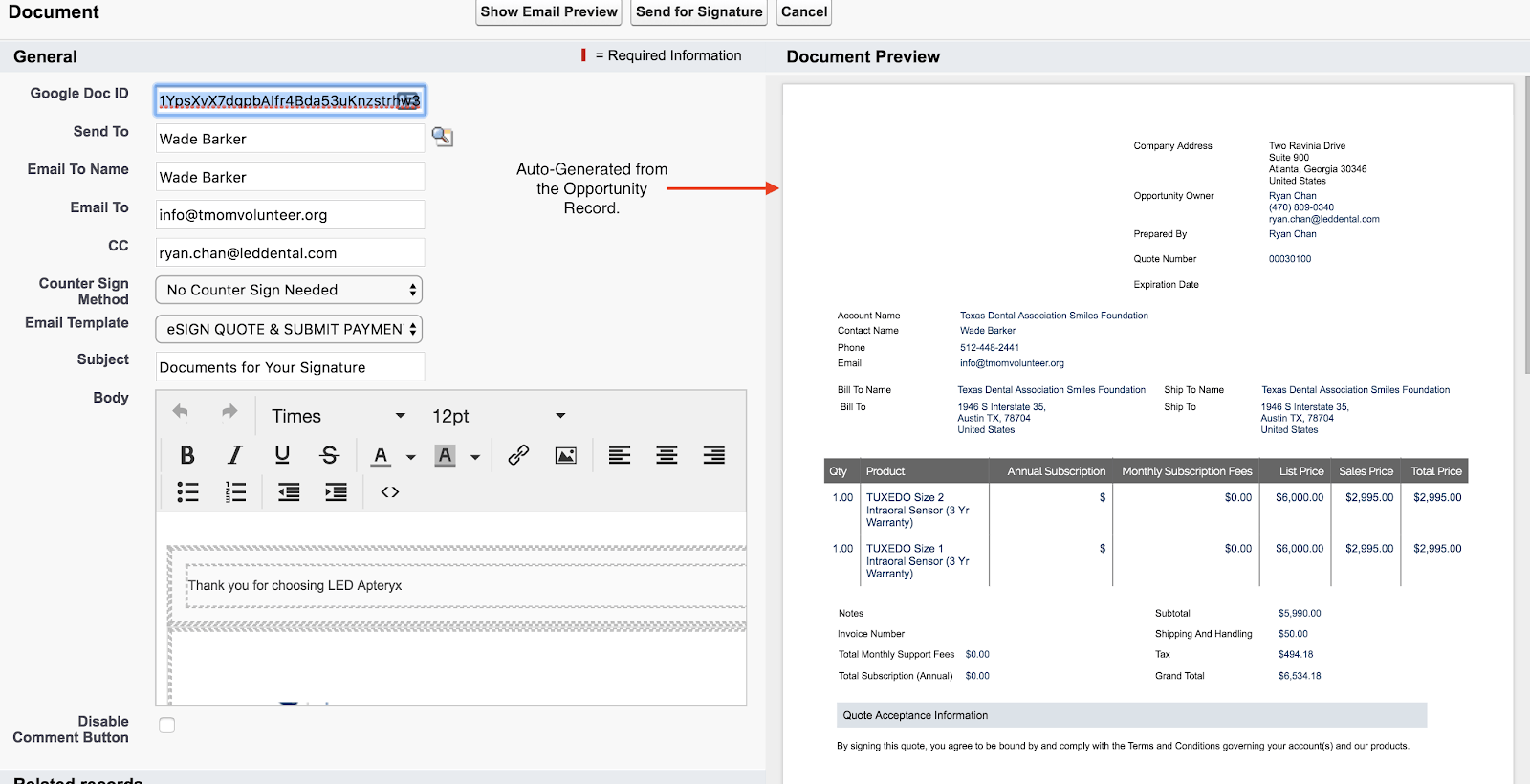

We began by streamlining Quote generation with our proprietary document-generation application A5 Documents to dynamically generate Quotes using Opportunity fields and the Opportunity Product related list. We then coupled A5 Docs with our proprietary eSignature solution A5 Signature enabling salespeople to send the automatically generated Quotes for eSignature to a Primary Contact on the Opportunity.

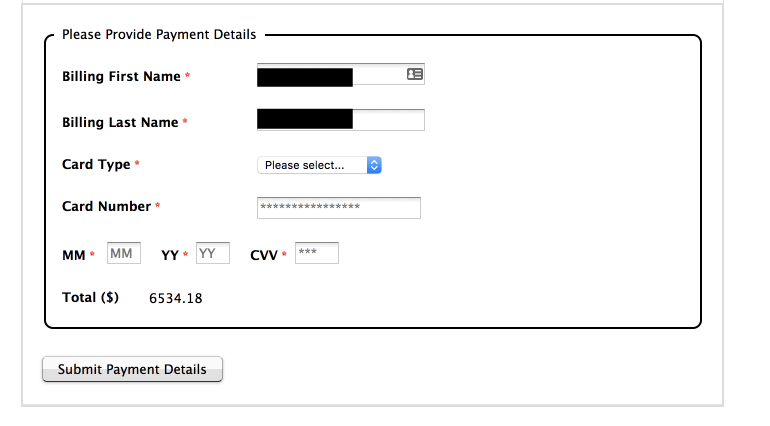

To accept payments from customers after they signed a Quote, we used Form Assembly, a powerful third-party form-building application that integrates with Salesforce and Chargent. A simple workflow rule sent a confirmation email letting the customer know their signed Quote had been received, in addition to providing them a link to a form through which they could pay for their product(s).

To segment Warranty and Product orders, we implemented filtered Rollup Summary fields on the Opportunity object to calculate the total cost of non-warranty and warranty products, respectively. When the customer submitted their credit card information, the system charged the amount in these Rollup Summary fields via two separate transactions; the product order was charged one-time, and the warranty order was charged one-time with an annual recurrence configured to charge the same amount year after the initial charge.

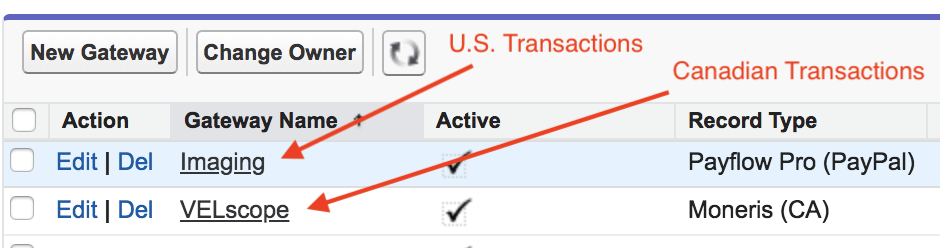

Because payments could’ve been processed in either Canada or the U.S., there was also a requirement to dynamically choose the appropriate payment gateway based on data in specific Opportunity fields. We implemented this Payment Gateway selection logic in a formula field in Salesforce, then queried the field result with Form Assembly using what’s known as a Pre-Fill connector. This allowed us to choose which payment gateway would process any particular transaction based on custom logic.

When a customer submits their card information, the charge is automatically processed and documented via a Chargent Order and Transaction record under the Opportunity in question. The (unencrypted) card information needn’t ever enter Salesforce, removing security risk in addition to the monotonous labor involved in charging credit cards manually.

To conclude this process, a simple workflow sets the Opportunity Stage to “Closed Won” once the Transaction record is successfully posted and related to the Opportunity.