We’re past the hype cycle. The latest AI-driven Salesforce trends 2026 reveal a fundamental shift in enterprise software. The market data tells the story: Gartner predicts that 40% of enterprise applications will include task-specific AI agents by the end of 2026, up from less than 5% today. IDC forecasts AI spending will reach $632 billion by 2028, with year-over-year growth of 31.9% between 2025 and 2029. This isn’t an incremental change — it’s a fundamental shift in how enterprise software operates.

The executives we work with aren’t asking whether AI will change their business—they’re asking how fast they can move without breaking things. After implementing dozens of Salesforce AI projects over the past year, three trends are emerging that separate the organizations making real progress from those still stuck in pilot purgatory.

1. Autonomous Agents Are Actually Working (When Implemented Correctly)

The trajectory is clear: Gartner’s best-case scenario projects that agentic AI could drive approximately 30% of enterprise application software revenue by 2035, surpassing $450 billion, up from just 2% in 2025. More immediately, the AI agents market itself is expected to grow from $7.38 billion in 2024 to $47.1 billion by 2030, representing a compound annual growth rate of 44.8%. Among the most impactful Salesforce AI trends, autonomous agents are demonstrating measurable ROI.

Real-World Impact

But market projections aside, the data coming out of early Agentforce Salesforce autonomous agent deployments is surprisingly good. According to Salesforce case studies, reMarkable deployed an AI agent named “Mark” in just three weeks and has since handled over 18,000 service conversations, with customer satisfaction scores improving week over week. Wiley reported achieving a 213% ROI from their Service Cloud integration, with Agentforce increasing self-service efficiency by over 40%.

These aren’t theoretical improvements. Real companies are reporting measurable operational transformation. Shoe Carnival expects Agentforce to handle 40% of customer call volume while reducing case escalations from 75% to 35%. Asymbl automated daily lead engagement and achieved coverage equivalent to a team five times larger, saving $575,000 annually while scaling targeted engagement by 427%.

Best Practices for Implementation

What makes these results possible? The agents aren’t just sophisticated chatbots — they’re autonomous systems capable of reasoning through multi-step processes. Salesforce’s own help site has handled over 1 million conversations with resolution rates of 86% and rising.

Lessons from Real Deployments

In our own implementations — including deployments for a leading food manufacturing company, a national real estate investment trust, a financial services firm, and internally at A5 — we’ve seen this pattern consistently: successful deployments start small, with tightly scoped use cases and obsessive attention to guardrails.

Common Pitfalls in Struggling Implementations

The pattern we observe in struggling implementations is consistent: organizations treat Agentforce like traditional automation — throwing requirements over the wall to IT and expecting magic. The more successful approaches look different. They start with high-volume, predictable interactions where the cost of failure is low. Password resets. Order status inquiries. Appointment scheduling. Once those work flawlessly, they expand to more complex scenarios.

→ Not sure if your organization is ready for autonomous agents? Download our free checklist: “52 Questions to Answer Before Deploying Your First Agent”

Psychological Value for Customers

Salesforce’s support team found that customers are more willing to ask AI agents questions they might hesitate to ask human representatives, likely out of fear of judgment or embarrassment. There’s genuine psychological value in having an autonomous system that never gets frustrated, never judges, and is available at 3 AM when your customer needs help.

Data Access and Security Considerations

The catch? Your agents will surface whatever data your users can access. Which means if your Salesforce permissions are a mess, you’re about to find out the hard way. In one of our financial services implementations, we discovered this during the first week of testing — the agent had access to client data that should have been restricted to specific teams. These results highlight the growing importance of AI-driven Salesforce trends 2026 for organizations adopting autonomous agents. Before deploying any agent, audit your security model. The agent doesn’t care about org charts or implicit trust — it follows permission sets.

Ready to explore how autonomous agents could transform your customer service or sales operations?

Let’s talk about your specific use case and what a phased deployment strategy would look like for your organization.

2. Data Cloud Isn't Optional Anymore — It's the Foundation

Why Data Cloud Matters

The numbers don’t lie: by 2027, 75% of hiring processes will include certifications and testing for workplace AI proficiency. By 2028, Gartner predicts that 90% of B2B buying will be AI agent-intermediated, pushing over $15 trillion of B2B spend through AI agent exchanges. These projections rest on a single assumption — that organizations have their data house in order. Most don’t.

Here’s the reality most enterprises face: data lives everywhere. Systems that don’t talk to each other. Customer records scattered across a dozen platforms. Marketing running on one version of reality while Sales operates on another. Another critical insight from AI-driven Salesforce trends 2026 is the non-optional nature of Data Cloud.

Zero-Copy Architecture Advantage

Data Cloud is forcing organizations to confront these issues because AI exposes every data quality problem that’s been accumulating. In Q1 fiscal 2026, Data Cloud’s annual recurring revenues grew 120% year-over-year and the platform stored more than 22 trillion data points. More than half of Fortune 500 companies are now using Salesforce Data Cloud AI , and the platform is generating approximately $7 billion in annual revenue for Salesforce.

The adoption numbers are staggering, but they don’t capture why Data Cloud is different from every previous data integration project. Nearly 60% of Salesforce’s top 100 deals in Q1 included both Data Cloud and AI capabilities, and roughly half of new Data Cloud bookings came from existing clients. That second statistic matters — existing customers expanding their investment signals real value, not just good salesmanship.

What changed? The zero-copy architecture. For decades, data integration meant expensive ETL processes, lengthy migration projects, and the risk of creating yet another data silo. Data Cloud connects to your existing infrastructure — Snowflake, Databricks, AWS, whatever you’re running — and activates that data within Salesforce without moving it. You’re not replacing your data warehouse; you’re unlocking its full potential.

When organizations implement Data Cloud, the conversation typically starts the same way: “We need unified customer data for our AI initiatives.” But the real work isn’t technical — it’s organizational. Who owns customer data governance? What’s your single source of truth for customer identity? How do you resolve conflicts when Sales says one thing and Marketing says another?

Results from Real Implementations

In our real estate client implementation, the challenges were instructive. The organization was dealing with duplicate lead records from every new inquiry, fragmented customer activity views across sales teams, and a disjointed tour booking process that made tracking engagement nearly impossible. Before we could deploy Agentforce agents, we had to solve the data architecture problem — introducing a community inquiry object to properly connect leads, accounts, properties, and tours, then automating inquiry creation with email-matching triggers to prevent duplication.

That foundation work enabled Data Cloud’s search and RAG capabilities to deliver significantly improved apartment search results based on city, community, and amenities. More importantly, it made the AI-powered tour booking agent actually useful — prospects could find available apartments matching their specific needs through conversational interfaces instead of frustrating manual searches and phone calls. The result: enhanced lead quality, reduced call center dependency, and increased occupancy rates. But none of that would have worked without fixing the underlying data structure first.

Data Cloud processed 7 trillion inbound records in a recent quarter, with 1.2 trillion activations that drove customer engagement. Those activations represent real business actions — personalized marketing messages, AI-generated insights, automated service workflows. But they only work when the underlying data is clean, current, and correctly mapped.

The organizations seeing results have invested in data governance before deploying AI at scale. They’ve established clear ownership, implemented quality controls, and defined their customer data model. The ones struggling are trying to use AI to fix their data problems, which doesn’t work.

→ Is your data infrastructure ready for AI? We offer comprehensive data architecture assessments that identify gaps, map integration requirements, and build governance frameworks before a single agent goes live.

3. Trust and Security Have Become Board-Level Concerns

Regulatory and Compliance Risks

Gartner’s prediction is stark: by the end of 2026, over 1,000 legal claims for “death by AI” will be filed due to insufficient guardrails. In sectors like healthcare, finance, and autonomous vehicles, the risks of poorly governed AI systems aren’t hypothetical — they’re material liabilities that boards and C-suites are now actively managing. Organizations need to implement trusted AI frameworks to ensure responsible Salesforce AI deployment.

Six months ago, Einstein Trust Layer was an IT talking point. Today, it’s showing up in board presentations and compliance reviews. The shift happened fast, driven by two forces: regulatory scrutiny of AI systems and the very real risk of autonomous agents making consequential decisions with bad data.

Einstein Trust Layer Capabilities

The Einstein Trust Layer isn’t marketing fluff. It includes zero data retention with large language models, data masking of sensitive information, and toxicity detection to filter biased or unethical responses. Salesforce Einstein Copilot and the Trust Layer help maintain governance and AI security standards. The system provides comprehensive audit trails recording how data is used and processed by AI models, creating transparency around agent decisions.

But here’s what matters for implementation: the platform handles infrastructure security, but you’re responsible for configuring it correctly. We’ve seen organizations deploy Agentforce with overly permissive access controls, essentially giving AI agents keys to the kingdom. The Trust Layer automatically tags records as “GDPR,” “HIPAA,” or “PII” based on predefined rules, enabling organizations to apply precise, policy-driven controls at the field, object, and record levels.

The regulatory landscape is tightening. The Trust Layer is designed to meet GDPR, HIPAA, and CCPA requirements, with features like automated consent management, data minimization workflows, and comprehensive audit trails to demonstrate compliance. For healthcare organizations, the system supports field-level audit trails with up to 10 years of retention and Shield Platform Encryption with FIPS 140-2 validation. Boards now consider AI-driven Salesforce trends 2026 when evaluating AI compliance and governance frameworks.

Configuring AI Security Properly

What we’re seeing in implementations across food manufacturing, financial services, and real estate: organizations in regulated industries are treating AI governance as a distinct discipline requiring cross-functional collaboration. Legal, compliance, IT, and business stakeholders need to agree on policies before the first agent goes live. Who approves AI decisions? What data can agents access? When does a human need to intervene?

At A5, we deployed Agentforce internally before recommending it to clients. That hands-on experience taught us that certain workflows need explicit human oversight built in from day one. Salesforce’s support team found that certain conversations are better suited for humans to handle, so they configured Agentforce to direct customers asking about renewals to live support engineers. That’s not a technical decision — it’s a business policy encoded in the system.

The organizations getting this right are building comprehensive frameworks now, before they’re forced to by regulation or incident. They’re defining acceptable use policies, establishing human oversight protocols, conducting regular security audits focused on AI-specific threats, and training teams on the unique risks of autonomous systems.

→ Need help establishing AI governance policies that balance innovation with compliance? Our team specializes in building security frameworks for regulated industries. Get the full Implementation Checklist.

What This Means for Your Organization

Interconnected Transformation

These three trends — autonomous agents, unified data platforms, and trusted AI governance — aren’t separate initiatives. They’re interconnected pieces of a larger transformation that Gartner estimates will account for nearly $58 billion in market disruption by 2027 as AI agents challenge mainstream productivity tools for the first time in 30 years. Staying ahead of AI-driven Salesforce trends 2026 requires clear strategy, robust data foundations, and trusted AI governance.

You can’t deploy effective agents without clean, unified data. You can’t scale AI responsibly without robust governance and security. Enterprises adopting AI in CRM 2026 are seeing measurable ROI and operational efficiency gains. Success depends on understanding and implementing AI-driven Salesforce trends 2026 across strategy, data, and governance. And according to IDC, the global economic impact of AI solutions and services will reach $22.3 trillion by 2030 — making this not just a technology decision, but a strategic imperative.

Gap Between Leaders and Laggards

The gap between leaders and laggards is widening. Organizations that started building these foundations six months ago are now deploying production agents handling real customer interactions. The ones still debating AI strategy are falling behind competitors who are shipping code.

Principles for Success

From our experience implementing these systems, success comes down to a few principles:

→ Start with strategy, not technology. Define clear business objectives and identify high-value use cases before you buy anything. “We need AI” isn’t a strategy.

→ Fix your data before deploying AI. You cannot automate your way out of data quality problems. Clean data, clear governance, and unified customer models are prerequisites, not nice-to-haves.

→ Build security and governance from the start. Bolting on compliance after deployment is expensive and risky. Establish policies, define access controls, and create audit mechanisms before your first agent goes live.

→ Embrace iterative deployment. Every successful Agentforce implementation we’ve seen started small, measured results obsessively, and expanded gradually. The failures tried to boil the ocean.

→ Invest in change management. Technology is the easy part. Getting your organization to trust AI, understanding when to intervene, training teams on new workflows — that’s where implementations succeed or fail.

The AI Revolution Is Here

The AI revolution isn’t coming — it’s here. The question facing executives isn’t whether to adopt these technologies but how to implement them in ways that create genuine business value while managing risk appropriately. Based on what we’re seeing in the field, 2026 will be the year that separates organizations making real progress from those still talking about it.

Frequently Asked Questions About Salesforce AI Implementation

How long does it typically take to implement Agentforce?

Implementation timelines vary based on complexity and data readiness. Simple use cases like password resets or order status inquiries can be deployed in 3-6 weeks with proper planning. More complex scenarios involving multiple systems and decision logic typically require 8-12 weeks. However, data preparation and security audits often take longer than the actual agent configuration. Organizations with clean data and clear governance policies move faster.

What's the typical ROI for Salesforce AI implementations?

Based on publicly available case studies, organizations are reporting ROI ranging from 213% to over 400% within the first year. Cost savings come from reduced call center volume (up to 40% reduction in some cases), increased self-service efficiency, and improved conversion rates. However, ROI depends heavily on implementation quality, use case selection, and data foundation. Organizations that skip data governance work rarely achieve projected returns.

Do we need Data Cloud to use Agentforce effectively?

While Agentforce can function without Data Cloud, effectiveness is significantly limited. Agents need unified, real-time customer data to deliver personalized, context-aware interactions. Organizations attempting to deploy AI agents on fragmented data typically see poor response quality and low user satisfaction. Nearly 60% of Salesforce’s top deals now include both Data Cloud and AI capabilities, reflecting this interdependency.

How do we ensure our AI agents don't expose sensitive customer data?

Security starts with proper permission architecture before deployment. The Einstein Trust Layer provides data masking, zero retention with LLMs, and audit trails, but you must configure access controls correctly. We recommend comprehensive security audits, field-level encryption for sensitive data, and least-privilege access principles. In regulated industries, involve legal and compliance teams from day one to establish data handling policies.

What industries are seeing the most success with Salesforce AI?

Early success is concentrated in industries with high-volume, repeatable customer interactions — retail, real estate, financial services, food service, and professional services. However, regulated industries like healthcare and financial services require additional governance work upfront. The key differentiator isn’t industry — it’s data maturity and organizational readiness for change management.

Can Agentforce integrate with our existing systems outside Salesforce?

Yes, through MuleSoft, APIs, and Data Cloud’s zero-copy architecture. Data Cloud connects to major platforms including Snowflake, Databricks, AWS, Google BigQuery, and custom systems. However, integration complexity increases with system age and data quality issues. Organizations with modern APIs and clean data structures integrate more smoothly than those with legacy systems.

What are the most common mistakes organizations make when implementing AI agents?

The top mistakes we observe: starting with overly complex use cases, skipping data governance work, inadequate security configuration, insufficient change management, and treating AI as a purely technical project. Organizations that succeed treat AI implementation as business transformation requiring cross-functional collaboration, clear KPIs, and iterative deployment strategies.

How much does Salesforce AI actually cost?

Agentforce pricing starts at $2 per conversation, with volume discounts available. Data Cloud uses consumption-based pricing tied to data volume and activations. However, total cost of ownership includes implementation services, data integration, ongoing maintenance, and training. Organizations should budget for the full ecosystem, not just licensing. Most enterprise implementations require 3-6 months of professional services support.

What kind of training do our teams need to work with AI agents?

Teams need both technical and conceptual training. Administrators require training on Agent Builder, prompt engineering, security configuration, and testing protocols. Business users need to understand when to escalate to humans, how to interpret agent performance metrics, and how to provide feedback for improvement. Change management is often more challenging than technical training.

How do we measure the success of our AI implementation?

Key metrics include conversation resolution rate, escalation rate, customer satisfaction scores, time to resolution, cost per interaction, and agent accuracy. However, metrics should align with specific business objectives. A sales agent might be measured by qualified leads generated or pipeline velocity, while a service agent focuses on first-contact resolution and CSAT scores. Establish baseline metrics before deployment.

Take the Next Step: Your AI Readiness Assessment

The gap between AI leaders and laggards is widening every quarter. Organizations that started building these foundations six months ago are now deploying production agents handling real customer interactions. The ones still debating AI strategy are falling behind competitors who are shipping results.

At A5, we’ve implemented Salesforce AI across food manufacturing, financial services, real estate, and our own operations. We understand what works, what doesn’t, and how to navigate the technical and organizational challenges that derail implementations.

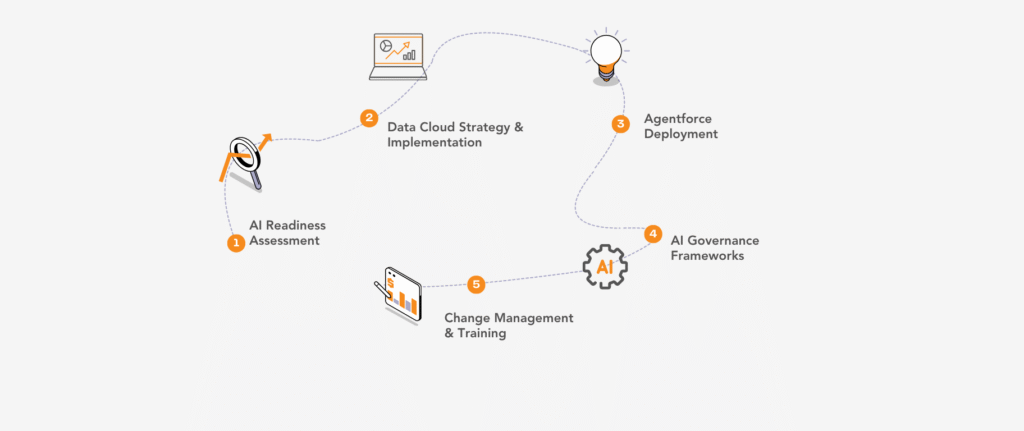

Here’s how we can help:

→ AI Readiness Assessment: Evaluate your data architecture, security posture, and organizational readiness for AI deployment (Read our AI Readiness framework)

→ Data Cloud Strategy & Implementation: Build unified customer data platforms with proper governance and integration

→ Agentforce Deployment: Design, build, and deploy autonomous agents with comprehensive testing and security protocols

→ AI Governance Frameworks: Establish policies, security controls, and compliance measures for regulated industries

→ Change Management & Training: Prepare your teams to work effectively with AI systems

The organizations winning with Salesforce AI aren’t the ones with the biggest budgets — they’re the ones with clear strategies, strong data foundations, and partners who understand implementation realities. Leaders who embrace AI-driven Salesforce trends 2026 holistically across data, automation, and security will outpace competitors.

Ready to move beyond pilots and into production? Contact A5 today to discuss your Salesforce AI strategy.

AI Implementation Checklist

Free Download → “The AI Implementation Checklist: 52 Questions to Answer Before Deploying Your First Agent” – Get our comprehensive pre-deployment assessment framework. Download the checklist