During a discovery session, one of our customer’s billing team members recently explained how they manually copy the invoice number from an excel spreadsheet every month into a billing system. They primarily have to do this due to the inability of their billing system’s current version to not automatically generate unique and sequential invoice numbers for generating an invoice document. Therefore, often the team encounters mistakes due to invoice numbers being repeated during subsequent month’s manual invoicing process. This sparks the conversation about the critical elements that make a good invoice and why we need an outstanding invoice? According to recent statistics, “84% of companies that work to improve their customer experience report an increase in their revenue.” A good invoice is the first step to creating that awesome customer experience that drives revenue.

However, when you send a quote for a job or service, it is not an invoice you sent their way, but a proforma invoice. A proforma invoice differs from a traditional invoice because it is sent to a customer before the job is done. Businesses usually create and send a proforma invoice to ensure the seller and the customer agree on the service requirement/product and the cost. Whether you are sending a commercial invoice or proforma invoice, invoicing needs to be simple, intuitive, and easy to follow.

Even as consumers, how often do we receive an invoice and struggle to find the exact date on which the payment is due? A term like ‘due on receipt,’ for example, creates ambiguity on whether a payment is due upon receipt of the goods/service or the receipt of the invoice. While this is not the first time we have heard of similar business processes for invoice creation and management, we believe there should be some best practices around the Invoice management processes.

What is an Invoice?

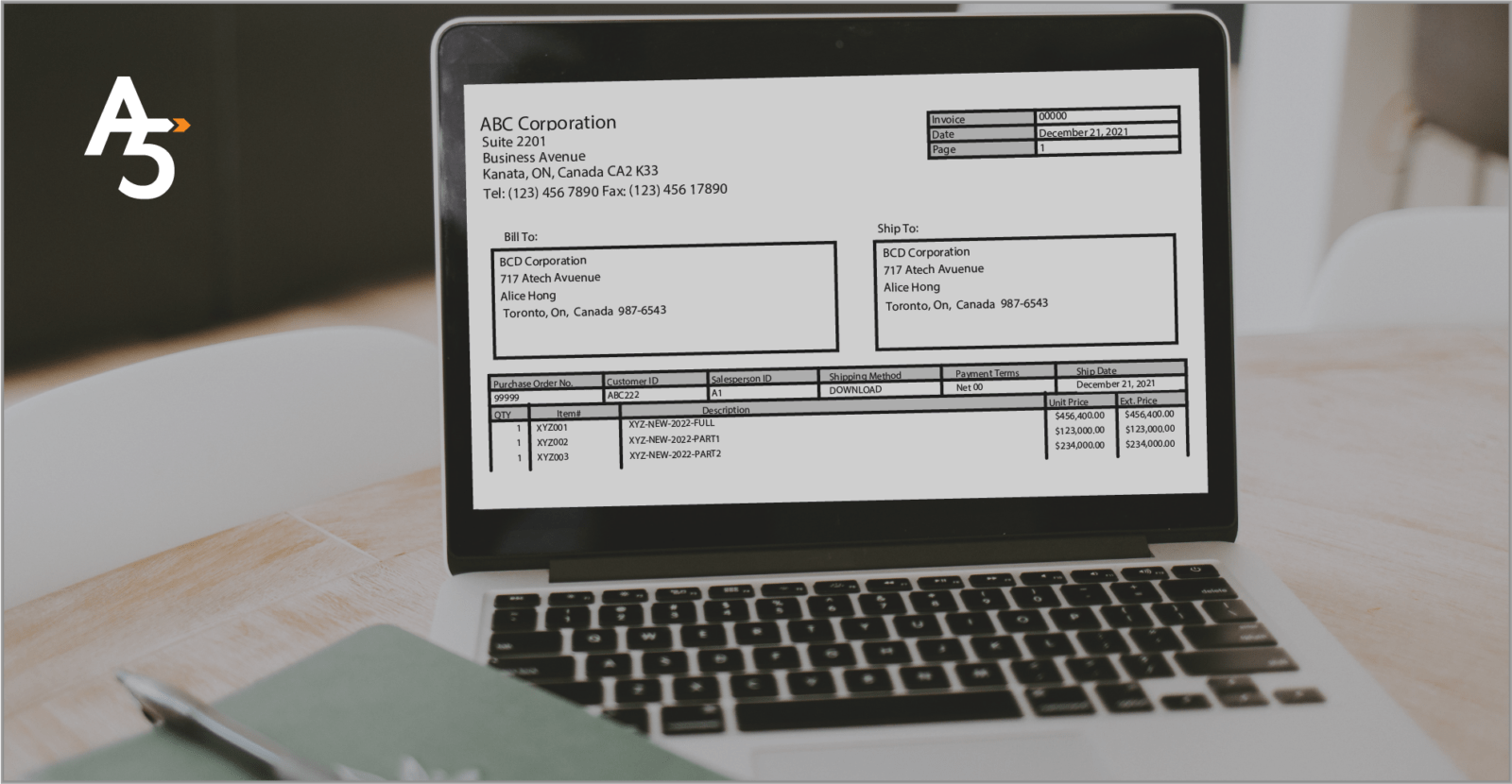

An invoice is a significant component of the Quote-to-Cash process as it is the trigger to receiving payments on time, the lifeblood of any company. In layman’s language, it is also called a payment statement or a bill. Invoices tend to become more of a marketing material than a means for getting the required details to the Accounts Payable team of the customers in a clear and precise manner. Knowing what Accounts Payable in an invoice means will help the customer to pay on time for their subscription or services they have opted for. In addition to the Product description, Unit of Measure, Quantity, and Price, below are a few other critical elements and considerations to design an invoice template.

Invoice Date and Invoice Number

Billing Company’s Name and Remittance Address

Presenting the Company’s name, remittance address, and bank account information encourages customers to pay proactively and reach out for any payment/invoice clarifications. It is common to set up a deposit-only account and reference that bank account number on the invoice. This prevents fraudulent withdrawals while providing clear instructions for the Accounts Payable team for payment.

Bill-to-information

Often in the B2B world, the Invoices are sent to the purchasing team upon the fulfillment of the order, which in most cases will be different from the customer’s Accounts Payable (AP) department.

One of the leading causes of payment delays is the AP not receiving the payment statement on time. The best practice is sending the invoice to Accounts Payable, which records it in their system and then routes it to the purchaser/requestor for approval. Providing contact information (email and / phone) ensures the customer can reach out if they need clarification about the generated payment statement. The customer account number should be displayed on the payment statement for easy reference.

Ship-to-information

Sales and Use Tax, VAT / GST, are usually calculated based on the customer’s shipping location. Since the Ship-To information may differ from the Bill-To information, capturing the Ship-to information on an invoice is essential.

Purchase Order (PO) Number

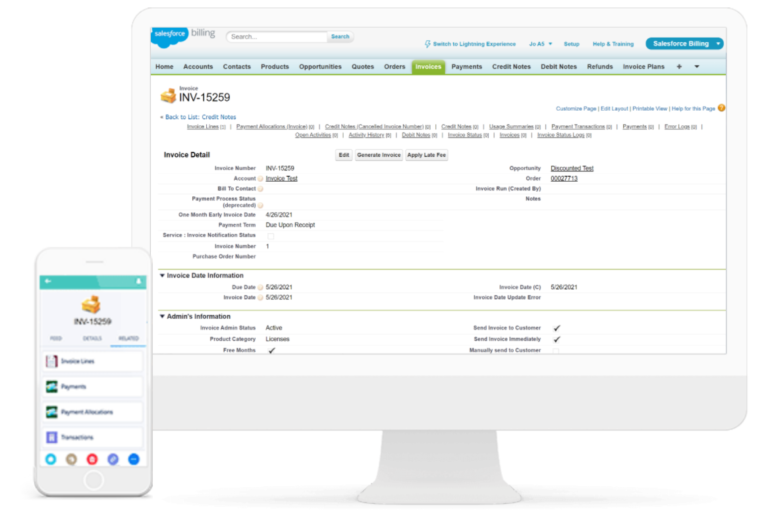

Laying out an invoice is both an art and a science. There is a lot of information that needs to be properly balanced and presented inside the invoice pages. Following the above-mentioned critical elements that make a good invoice, you can definitely create a better customer experience for your customers. Want to streamline your billing processes? Wish to come out of the manual billing errors? Salesforce Revenue Cloud can be a great tool to boost your customer experience as well as employee experience and sales experience? Too good to believe, we can help demonstrate and orchestrate it for you.