Managing contracts can be a complex and time-consuming process. But what if there was a way to streamline this process, save money, and even boost your revenue? Enter Enterprise Contracts Management (ECM) systems. While the initial investment for a full-scale ECM solution might seem daunting, reaching up to $10 million over five years, the ongoing costs are a mere fraction of that – around $250 per contract, often less than the price of a new phone!

According to a report published by World Commerce And Contracting, most businesses handle a staggering 20,000 to 40,000 active contracts annually. The financial advantages of implementing ECM quickly become clear. Additionally, the growing emphasis on corporate transparency and regulatory compliance is driving a surge in interest in ECM solutions.

Beyond the potential legal and financial risks associated with non-compliance, there are numerous ways to make the business case for ECM financially attractive. By streamlining processes, optimizing resource allocation, improving vendor management, reducing external legal fees, and achieving greater contract effectiveness, organizations can expect to see significant benefits exceeding $30 million over five years.

The Financial Impact of ECM Solutions

Organizations can save an average of 2% of annual costs by implementing ECM solutions. This translates to significant cost savings for businesses of all sizes. A study by IACCM revealed that good contract management could increase a company’s profitability by a whopping 9%. Improved contract management has a direct impact on the bottom line.

Process Improvement

71% of companies cannot find 10% or more of their contracts, highlighting the inefficiency of manual contract management. ECM solutions can significantly improve contract visibility and accessibility. According to a Goldman Sachs report “Automation of contract management processes accelerates negotiation cycles by 50%”. ECM streamlines workflows and reduces negotiation timeframes.

In this detailed blog/article, we will equip you with the insights and guidance needed to build a compelling business case and secure leadership buy-in for implementing ECM in your organization.

Building A Solid Business Case: Understanding The Key Components Of ECM

This blog/article will delve into the five key components of a typical business case for ECM:

- The Advantages of ECM: Discover how ECM streamlines processes, boosts efficiency, and unlocks significant financial benefits.

- Enhancing ECM with Artificial Intelligence (AI): How AI can enhance your ECM function to get the most out of your ECM investments.

- Costs Associated with ECM Solutions: We’ll explore the breakdown of costs and different hosting options to fit your organization’s needs.

- Implementation Considerations: Understand the factors that impact implementation workload and costs.

- Building a Successful Implementation Strategy: Learn how to develop a multi-phase deployment plan to maximize ROI and secure ongoing leadership support.

Unveiling the Advantages of ECM

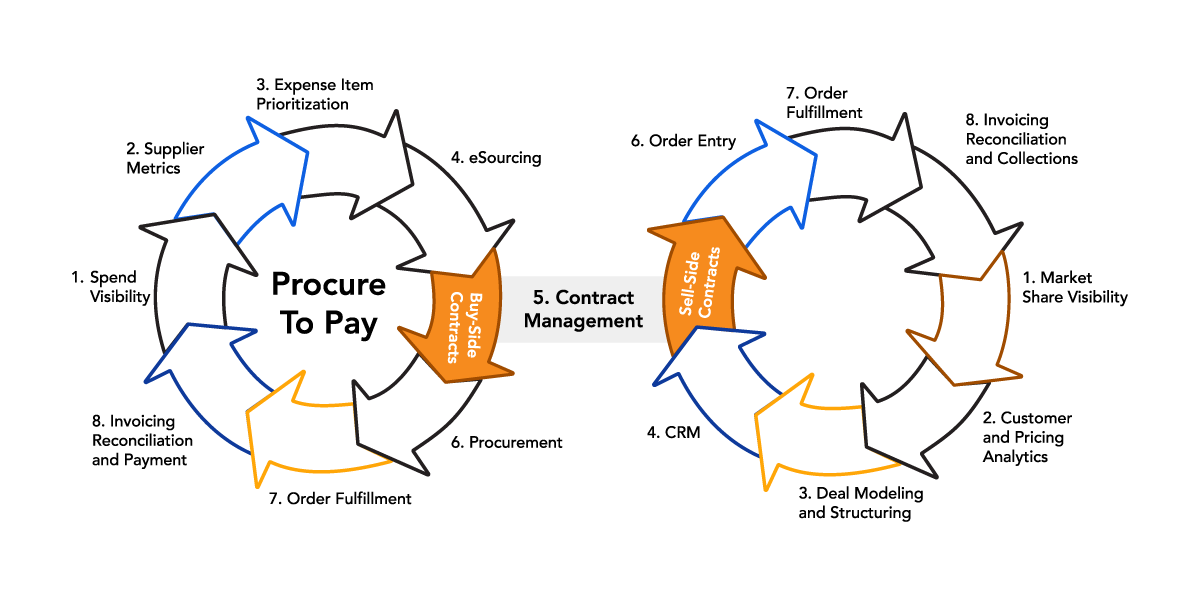

Contract Management: The Cornerstone of Streamlined Processes

- Reduced cycle times by an average of 33%

- Increased standardization of deals to 90%

- Decreased non-standard deals by 20%

- Faster turnaround times for special pricing agreements (2-4 days)

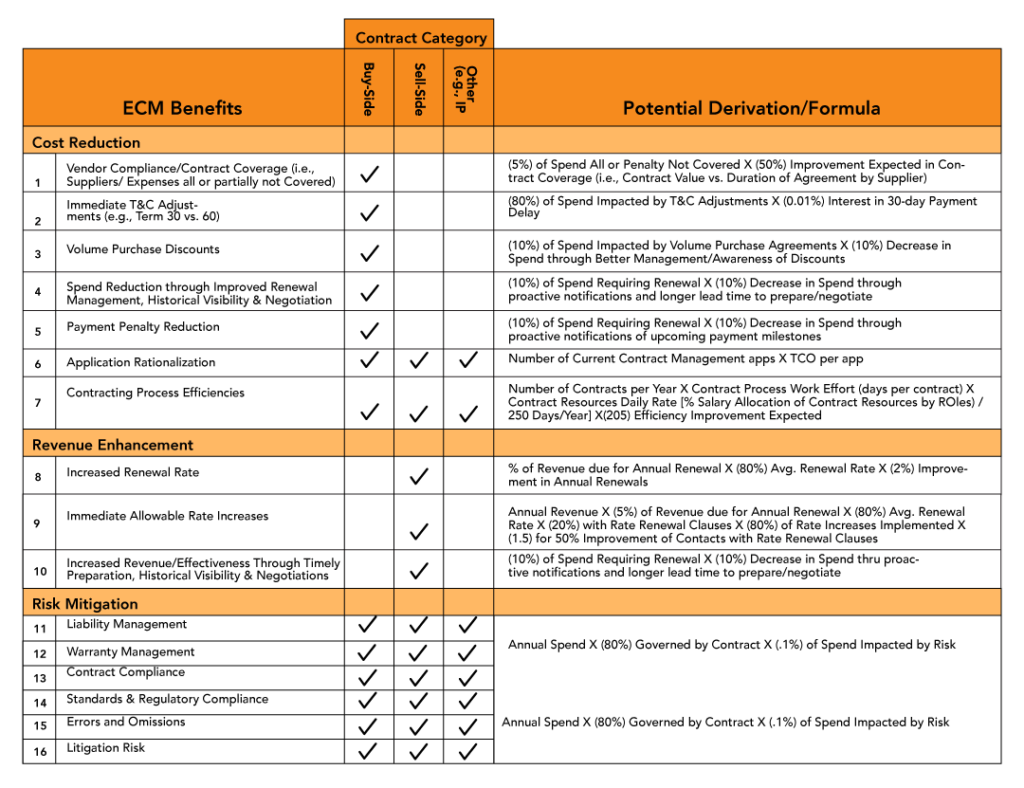

Tailored Benefits for Different Contract Categories

Buy-Side Contracts: Optimizing Spend and Minimizing Risk

Benefits for Sell-Side Contracts

- Increased throughput of contract renewals

- More frequent implementation of rate increases

- Improved effectiveness of future contracts, ensuring mutually beneficial outcomes for both parties and a greater likelihood of continued partnership.

Benefits for Risk Mitigation

Risk mitigation benefits apply to all contract types, as risk is inherent in any contractual agreement. The table outlines some common risks, including liability, warranty, contract compliance, adherence to standards and regulations, errors and omissions, and general liability. While assigning a specific dollar value to this category can be challenging, the potential financial impact can be significant.

Organizations might be hesitant to disclose instances where poor contract compliance resulted in million-dollar errors. Depending on the industry, highlighting publicly known examples of fines, litigation awards, or settlements can be just as compelling. By referencing these examples, you can estimate a reasonable dollar figure to assign to risk. Even a small fraction of this potential risk amount can be used to quantify the value of a contract management solution that helps mitigate such risks. The chart below showcases a few examples from client organizations’ contract assessments, emphasizing the importance of risk mitigation when building a business case for Enterprise Contract Management Solution.

Enhancing ECM with Artificial Intelligence (AI)

Enterprise Contract Management (ECM) systems are undergoing a revolution thanks to Artificial Intelligence (AI). AI can significantly boost the efficiency and effectiveness of ECM, leading to even greater financial advantages for organizations. Here’s how:

- Smart Automation: AI can automate repetitive tasks such as contract data extraction, clause identification, and risk assessment. This frees up valuable time for legal and procurement teams to focus on strategic initiatives like negotiating better contracts and managing complex vendor relationships.

- Advanced Analytics: AI can analyze vast amounts of contract data to identify trends, patterns, and potential risks.This enables organizations to proactively address issues before they escalate into costly problems. For example, AI can identify contracts nearing expiration or those with unfavorable terms, allowing for renegotiation or mitigation strategies.

- Intelligent Search: AI-powered search functionalities allow for quick and easy retrieval of specific contract information. Imagine needing to find a specific clause about intellectual property rights across thousands of contracts. With AI search, you can find the exact clause in seconds, saving significant time and effort.

- Predictive Insights: AI can analyze historical data to predict potential issues with contracts, such as expiring terms or upcoming renewal negotiations. This allows organizations to be proactive in managing their contracts and avoid costly mistakes. For instance, AI can predict potential delays in contract approvals based on past performance,allowing teams to take steps to expedite the process.

- Enhanced Negotiation Support: AI can suggest optimal contract terms based on industry benchmarks and historical data. This empowers negotiators to secure the best possible deals for their organizations. Imagine having an AI assistant that recommends the most favorable language for a specific clause based on similar successful contracts.

- Improved Risk Management: AI can identify potential legal and financial risks within contracts, allowing organizations to take steps to mitigate them. This can save businesses from costly legal disputes and financial losses. By analyzing contract language, AI can flag potential risks like ambiguous terms or hidden fees, allowing for clarification or renegotiation before signing.

By leveraging AI, ECM systems can become even more intelligent and efficient, helping organizations streamline contract management processes, reduce costs, improve profitability, and gain a competitive edge.

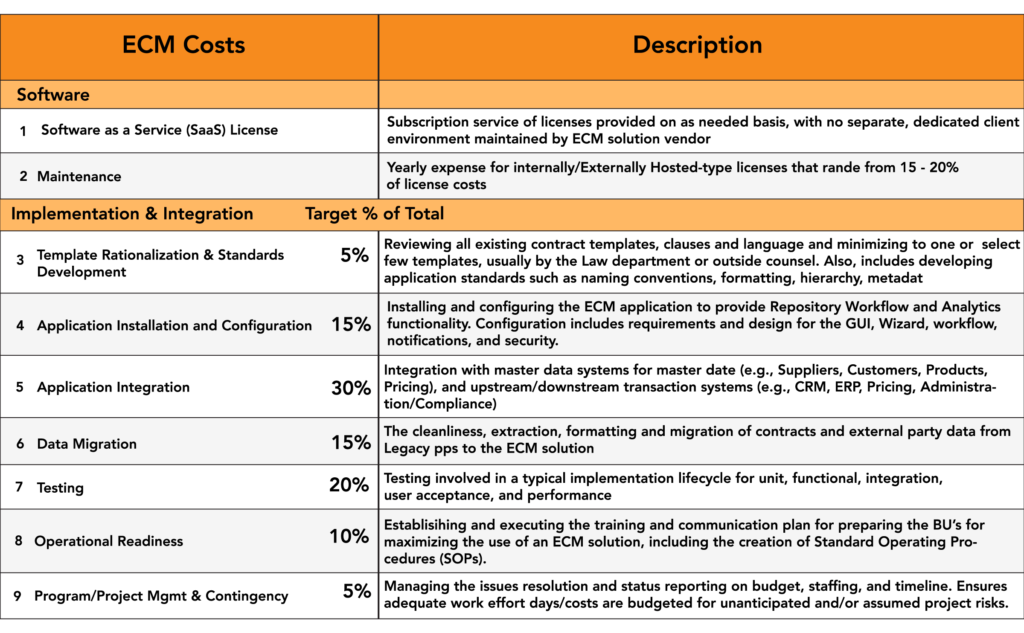

Costs Associated with ECM Solutions

- Software Licensing: This is the upfront cost of the ECM software itself. Pricing models can vary depending on the vendor, features chosen, and number of users.

- Implementation Services: Implementing an ECM system requires professional services to configure the software,migrate data, and train users. Costs can vary depending on the complexity of your system and the level of customization required.

- Ongoing Maintenance and Support: After implementation, ongoing maintenance and support fees are necessary to ensure the system is up-to-date and functioning properly.

- Training: Training your staff on how to use the new ECM system is crucial for successful adoption. Factor in training costs when calculating the TCO.

Reducing Costs:

- Needs Assessment: Clearly define your organization’s specific needs before selecting an ECM solution. Don’t pay for features you won’t use.

- Phased Implementation: Implement the ECM system in phases, starting with core functionalities. This can help spread out costs and minimize disruption.

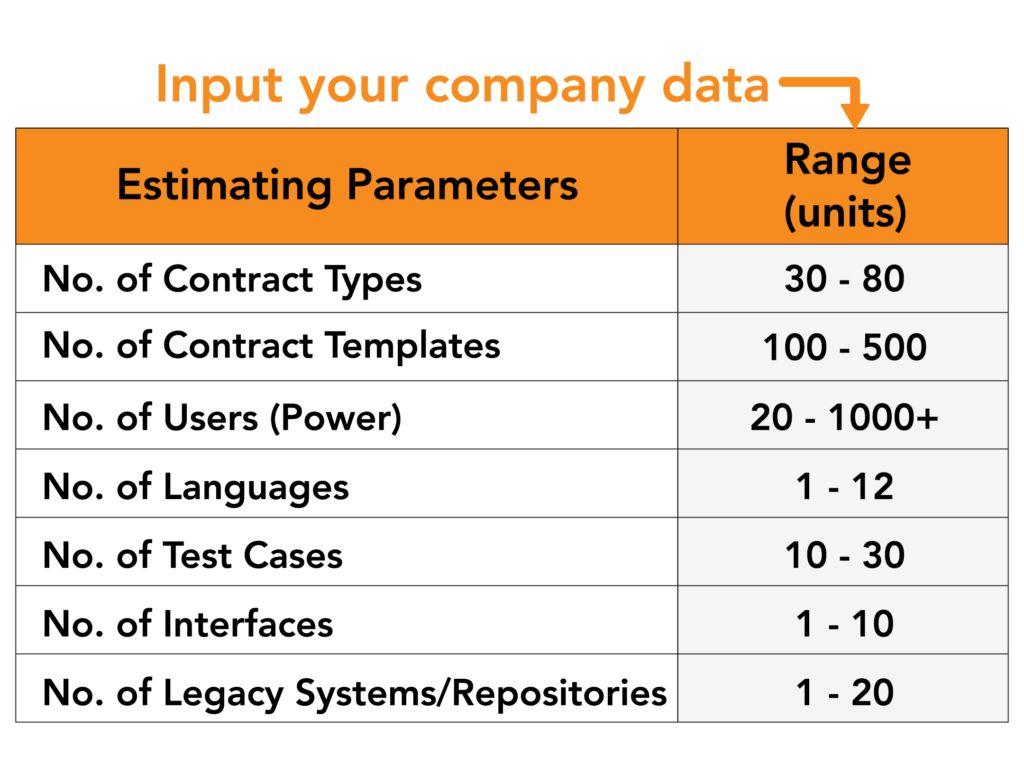

Implementation Considerations

A successful Enterprise Contract Management system implementation requires careful planning and consideration of several factors:

- Project Scope: Clearly define the scope of your ECM project, outlining the functionalities you want to implement and the departments involved.

- Data Migration: Migrating existing contract data to the new ECM system can be a complex task. Develop a robust data migration strategy to ensure accuracy and completeness.

- Change Management: Implementing a new ECM system will impact your workflows and user behavior. Develop a change management plan to effectively communicate the transition and encourage user adoption.

- System Integration: Your ECM system may need to integrate with other enterprise applications like CRM or ERP systems. Ensure compatibility and plan for seamless data exchange.

- User Training: Provide comprehensive training to all users on how to navigate and utilize the ECM system effectively.

- Security and Compliance: ECM systems house sensitive contractual information. Ensure the chosen solution meets your organization’s security and compliance requirements.

Building a Successful Implementation Strategy

A well-defined implementation strategy is key to maximizing the return on investment (ROI) from your Enterprise Contract Management system. Here are the steps involved:

- Establish a Project Team: Assemble a cross-functional team with representatives from legal, procurement, IT, and other relevant departments.

- Develop a Project Plan: Create a detailed project plan outlining timelines, milestones, deliverables, and resource allocation.

- Identify Success Metrics: Define key performance indicators (KPIs) to measure the success of your ECM implementation. This could include reduced contract processing times, improved contract visibility, or cost savings.

- Phased Implementation: Consider a phased approach where core functionalities are implemented first, followed by more advanced features. This allows for user familiarization and reduces initial disruption.

- Change Management Communication: Develop a comprehensive communication plan to keep stakeholders informed throughout the implementation process. Address concerns and encourage user adoption.

- Post-Implementation Support: Provide ongoing support to users after the system is deployed. Address any challenges and continue to optimize the ECM system for maximum benefit.

By following these steps and considering the cost factors and implementation challenges, you can ensure a successful ECM implementation that streamlines contract management processes, boosts efficiency, and delivers a strong ROI for your organization.

Taking the Next Step

If you’re ready to explore how Enterprise Contract Management system with AI can transform your organization’s contract management, contact us today to schedule a consultation. We’ll help you assess your needs and identify the right ECM solution to achieve your business goals.