If you’ve sat in a steering committee meeting recently, you’ve likely noticed a shift in the language. The conversation has moved from simple “quoting” to a complex alphabet soup of CPQ, RLM, RCA, ARM, LTC and QTC (often referred to as Q2C). For many business leaders, navigating this maze of Quote-to-Cash terminology feels less like strategy and more like a distraction — just another rebranding exercise from the software giants.

But dismiss it at your peril.

At A5, we’ve audited over 60 Quote-to-Cash implementations in the past three years. What we’ve discovered: 68% of stalled projects fail not because of technology limitations, but because stakeholders are using the same acronyms to mean fundamentally different things. The way we define these terms dictates how we build our systems. Get the definition wrong, and you risk building a fragile architecture that becomes technical debt within 18 months. Get it right, and you unlock the kind of agility that defines market leaders.

Whether you are a CIO, a CFO, or a RevOps leader, here is the strategic context you need to decode the evolving Quote-to-Cash terminology and build a roadmap for growth.

What is Quote-to-Cash (QTC)?

Before decoding the new acronyms, we must ground the definition. Mastering foundational Quote-to-Cash terminology is essential because QTC (or Q2C) refers to the end-to-end business process of driving revenue, starting from a customer’s intent to buy (configuration and pricing) and ending with revenue realization (billing and cash collection). Unlike Order-to-Cash (O2C), which begins only after the sale is closed, QTC encompasses the entire sales, legal, and finance lifecycle.

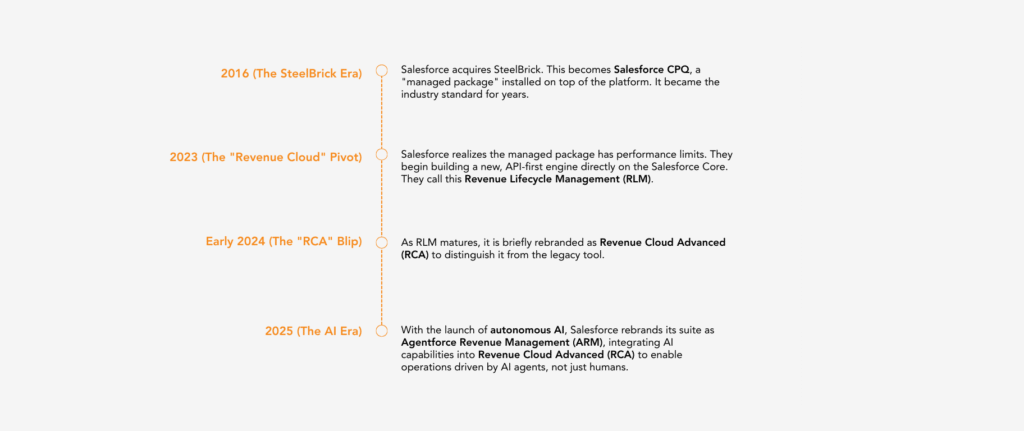

The Timeline: How We Got Here

To understand the current acronyms, you have to understand the journey Salesforce took to get here. The confusion stems from three major shifts in strategy over the last decade:

Salesforce CPQ vs. Agentforce (RLM): The Architecture Shift

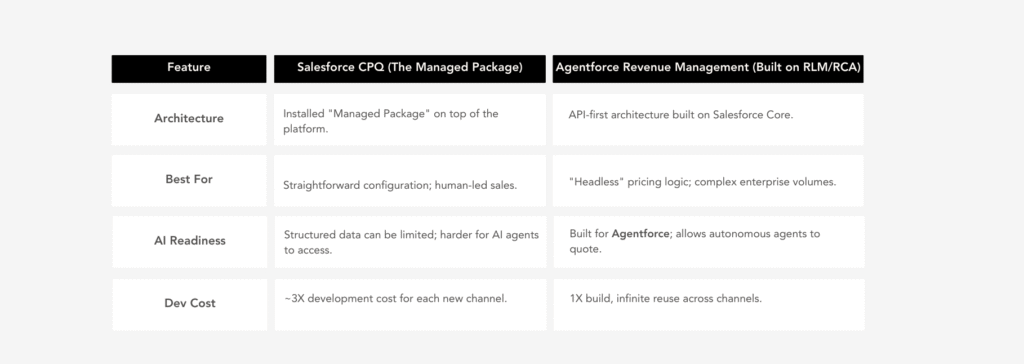

Now that you know the history, we can look at the architecture. The critical decision today is between the legacy standard (Salesforce CPQ) and the new engine (Agentforce/RLM). When weighing these options, understanding the nuances of modern Quote-to-Cash terminology is vital for your architecture strategy.

The Update: While the official name is now Agentforce Revenue Management, the underlying engine is still widely referred to by architects as RLM.

- Salesforce CPQ (The Managed Package): Built as a package installed on top of the platform. It is excellent for straightforward configuration but can hit performance limits at extreme enterprise volumes.

- RCA(The Engine): This is Revenue Cloud Advanced (earlier known as Revenue Lifecycle Management- RLM). It is the underlying, API-first architecture built on the Salesforce Core that allows pricing logic to be “headless.”

- Agentforce (The Driver): The AI layer that sits on top of RCA. It uses autonomous agents to perform tasks like “Draft a quote for this renewal” or “Amend this contract based on the email request.”

The Consultant’s Take: When weighing Salesforce CPQ vs. Agentforce Revenue Management, remember: you cannot skip straight to AI. Autonomous agents require the structured, API-accessible data model of RLM/RCA to function. If you are still on legacy CPQ with unstructured data, your AI strategy will fail because the agents won’t have a “clean” map to read.

The CIO’s Calculation:

- Legacy CPQ: 3X development cost for each new channel (web, mobile, partner).

- Agentforce Revenue Management: 1X build, infinite reuse.

This API-first architecture is the only path that allows Agentforce agents to quote autonomously without expensive custom integration.

The "ARM" Conflict: A Tale of Two Systems

If there is one area where we see projects go off the rails, it’s the collision of the acronym ARM.

In a cruel twist of fate, both Salesforce and NetSuite (Oracle) utilize this acronym, and they both sit at the critical intersection of Sales and Finance. We recently audited a stalled $2.3M project where the team was trying to force Salesforce to handle complex, multi-book accounting compliance — simply because they bought a module called “Revenue Management.”

Here is the clarity you need to bridge the gap between IT and Finance:

- Salesforce ARM (Agentforce Revenue Management) is your windshield. It is designed for Operational Forecasting. It allows your RevOps team to see revenue schedules and manage contract amendments before the invoice is finalized. It answers the question: “How much revenue will we recognize next quarter?“

- NetSuite ARM (Advanced Revenue Management) is your rearview mirror (and your auditor’s best friend). It lives in the ERP and is the system of record for ASC 606 compliance. It answers the question: “Is this financial report legally accurate?”

The Strategic Fix: Don’t treat these as competing tools. Use Salesforce to capture the operational intent (the Order) and pass it to NetSuite to handle the heavy compliance math. Clarity in roles prevents redundancy in integration.

The CFO’s Risk Assessment: We’ve seen companies face audit findings because they treated operational forecasting tools as systems of record. The remediation cost? One client spent $800K unwinding revenue recognition errors that stemmed from this exact confusion.

A Glossary of Modern Quote-to-Cash Terminology

When we kick off a digital transformation, one of our first steps is harmonizing the language. Ambiguity creates technical debt. Here is the “cheat sheet” regarding Quote-to-Cash terminology we recommend for your internal teams:

The Modern Quote-to-Cash Architecture Flow

To visualize how these terms fit together, consider the sequential flow of data:

- Configuration: Selecting bundled products and attributes.

- Pricing: Applying logic and margins.

- Quoting: Generating the document.

- Contracting (CLM): Legal negotiation.

- Ordering: Converting quote to order.

- Revenue Management: Forecasting and Recognition.

Key Definitions

✓L2C (Lead-to-Cash): The “Full Lifecycle.” Common in European markets, covering everything from the first Marketing Lead to the final Cash collection.

- Executive impact: The only view that shows true customer acquisition cost vs. lifetime value.

✓ QTC / Q2C (Quote-to-Cash): The holistic quoting process within L2C. It’s not a software; it’s the journey your customer takes from “I’m interested” to “Invoice Paid.”

- RevOps impact: End-to-end visibility reduces sales cycle by 15-30%.

✓CPQ (Configure, Price, Quote): The holistic process within Q2C that guarantees accurate pricing. It stops sales reps from selling products that don’t exist at prices you can’t honor. Also can refer to the specific Salesforce CPQ software (formerly Steelbrick)

- Sales impact: Reduces quote errors by 70-85% in our client implementations.

✓RLM/RCA (Revenue Lifecycle Management / Revenue Cloud Advanced): The next-generation architecture. Think of this as the “brain” of revenue that can be accessed by any “limb” (web, mobile, partner portal).

- CIO impact: Enables channel expansion without proportional IT investment.

✓ARM (Agentforce Revenue Management): The next-generation architecture enhanced with Agentforce for agentic AI-driven revenue management.

✓ CLM (Contract Lifecycle Management): The legal layer. We often see companies disconnect this from quote, leading to “leakage” where the signed contract doesn’t match the approved quote.

- Finance impact: Unintegrated CLM costs companies an average of 3-7% of contract value in unbilled services and pricing mismatches.

What This Means for Your Role

For the CFO: Financial Risk and Opportunity Cost

The terminology confusion isn’t just annoying — it’s expensive. When teams misalign on what “Revenue Management” means, we see:

- Audit risk exposure: Using operational tools as compliance systems of record

- Revenue leakage: 3-7% of contract value lost to mismatched quotes and contracts

- Forecasting inaccuracy: Revenue predictions off by 15-25% due to siloed data

- Delayed close: Month-end close taking 2-4 extra days due to manual reconciliation

The A5 Framework:

We use a three-layer revenue governance model that clearly separates operational capture (CRM), revenue intelligence (middleware), and compliance recording (ERP). This prevents the “one system to rule them all” trap that creates both IT complexity and audit exposure.

For the CIO: Architecture Decisions with 5-Year Consequences

With AI entering the quote process, these architectural decisions are becoming permanent faster than ever. The systems you choose today will either enable or constrain your AI strategy tomorrow.

The critical decision: Are you building a monolithic revenue system or a composable revenue architecture?

Our assessment shows that companies with composable architectures (RCA-style, API-first) can integrate new AI pricing models in 4-6 weeks. Companies with legacy, tightly-coupled systems are looking at 6-9 month projects for the same capability.

The A5 Maturity Model:

We assess clients across five dimensions: Data Architecture, Process Integration, Channel Readiness, Compliance Separation, and AI-Readiness. Most companies score 2.1 out of 5. Market leaders score 4.2+.

For RevOps: Speed and Accuracy as Competitive Advantage

Your team lives in the gap between what Sales promises and what Finance can deliver. Terminology confusion makes that gap wider. When your CPQ, CLM, and ARM systems speak different languages:

- Quote-to-contract time increases by 40-60%

- Amendment cycles take 2-3X longer than they should

- Revenue forecasts require manual spreadsheet reconciliation

- Deal desk becomes a bottleneck instead of an accelerator

The A5 Approach:

We map your quote-to-cash process before we touch technology. We’ve found that 80% of “system problems” are actually process ambiguity problems. Our Process Design Workshops align stakeholders on definitions before a single field is configured.

The A5 Revenue Architecture Diagnostic

Here’s the uncomfortable truth: Most companies are over-investing in CLM and under-investing in ARM. They’re spending six figures on contract management tools while their sales teams are still building quotes in spreadsheets. They’re implementing sophisticated revenue recognition engines while their order-to-invoice process is held together with manual data entry.

We see four common anti-patterns:

Take the Assessment

Answer these five questions honestly:

- Can your sales team generate a legally-binding quote in under 30 minutes for your most complex product?

- If you launched a self-service portal tomorrow, could it use the same pricing logic as your sales team?

- Does your RevOps team trust the revenue forecast in your CRM, or do they maintain shadow spreadsheets?

- Can you amend a contract without involving three departments and a two-week approval cycle?

- If your auditor asked for the revenue recognition logic for a specific deal, could you produce it in under 24 hours?

If you answered “no” to two or more, you have architecture debt, not just terminology confusion.

What Separates Leaders from Laggards

The companies winning in the new revenue economy share three characteristics:

- Architectural Clarity: They know exactly which system is responsible for what, and they resist the temptation to make one system do everything.

- Process-First Thinking: They map the business process before selecting technology, not the other way around.

- Composable Design: They build systems that can be reconfigured as the business evolves, not monolithic platforms that require 18-month projects to change.

At A5, we don’t just implement software. We architect revenue systems that serve your strategy, not the other way around. Our Revenue Architecture Blueprint has helped clients reduce quote-to-cash cycle time by 40%, eliminate revenue leakage of 3-7%, and achieve audit-ready compliance without sacrificing sales agility.

Your Next Step: The Revenue Architecture Readiness Assessment

The future of revenue is integrated, intelligent, and fast. But you can’t build that future on a foundation of confusion. We can help you cut through the noise of complex Quote-to-Cash terminology and build a revenue architecture that scales.

We’re offering a complimentary Revenue Architecture Readiness Assessment to qualified organizations. In a 90-minute working session, we’ll:

- Map your current QTC architecture and identify integration gaps

- Benchmark your maturity against industry leaders in your sector

- Identify the top three architectural decisions that will unlock or constrain your growth

- Provide a prioritized roadmap with estimated ROI for each initiative

This isn’t a sales pitch disguised as a meeting. It’s a diagnostic session led by our Principal Salesforce Revenue Architects who have designed revenue systems for companies from $50M to $5B in revenue.

The catch: We only have capacity for 8 assessments per quarter, and we’re selective about fit. This is designed for organizations with complex revenue models (subscriptions, usage-based, multi-entity) who are serious about transforming their quote-to-cash process in the next 12 months.

If you’re ready to move beyond the alphabet soup and start building a revenue architecture that scales, Request Your Assessment Here or email us directly at info@A5corp.com to start the conversation.

The terminology will keep evolving. Your architecture shouldn’t have to.