The enterprise software landscape has reached a pivotal moment. As we advance through 2025 and look toward 2026, the “best-of-breed” approach that dominated the previous decade is giving way to comprehensive enterprise software consolidation. Today’s most successful organizations are discovering that enterprise software consolidation — the strategic unification of disparate tools onto unified platforms — delivers competitive advantages that fragmented technology stacks simply cannot match.

The Great Platform Consolidation: What the 2025 Numbers Tell Us

According to Grand View Research, the global enterprise software sector has demonstrated remarkable growth, with valuations rising from approximately USD 263.79 billion in 2024 to projected revenues exceeding USD 517.26 billion by 2030 — representing a compound annual growth rate of over 12.1% from 2025 to 2030. Yet this growth isn’t driven by tool proliferation — it’s powered by consolidation onto comprehensive platforms.

Industry analysts report that the Enterprise Software market worldwide is expected to experience consistent growth of approximately 6.18% (2025-2029) annually through 2029, with cloud-based architecture platforms now commanding 60% of market share as of 2025. This massive shift toward unified platforms reflects a fundamental change in how organizations approach technology strategy.

The answer to digital transformation challenges increasingly lies not in adding more tools, but in platform consolidation. Gartner predicts that 40% of enterprise applications will be integrated with task-specific AI agents by 2026, up from less than 5% today — a capability that’s only achievable through unified platform architectures.

The Best-of-Breed Illusion: Why "Perfect" Tools Create Imperfect Systems

Enterprises often purchase software from different vendors to obtain the best-of-breed offering for each application area, as Gartner notes. The logic seems sound: choose the absolute best CRM, the best marketing automation tool, the best analytics platform, and connect them all together. What could go wrong?

Everything — which is precisely why enterprise software consolidation has emerged as the superior strategy for organizations seeking sustainable competitive advantage.

The Hidden Costs of Integration Hell

A recent analysis of a $19 billion global manufacturing company (let’s call them “GlobalCorp”) reveals the true cost of best-of-breed approaches. When GlobalCorp began their digital transformation journey, they faced:

- Heavy technical debt across fragmented legacy systems

- Disconnected operations across multiple regions

- Siloed marketing and lead generation systems

- The inability to achieve unified reporting and analytics

Sound familiar? This scenario plays out in enterprises worldwide, where best-of-breed creates what I call “integration hell” — a state where the cost and complexity of connecting disparate systems exceeds their individual benefits.

The AI and Platform Convergence: Why 2025-2026 Changes Everything

The most compelling driver for platform consolidation in 2025 isn’t operational efficiency — it’s AI readiness. McKinsey’s 2025 State of AI report reveals that 72% of organizations have now adopted generative AI in at least one business function, up from 65% in 2024. However, only 1% of companies have actually reached AI maturity, with 92% of businesses planning to increase their AI investments this year.

This massive gap between AI adoption and AI maturity is largely explained by data architecture limitations. As per the analyst reports, the enterprise data integration market is projected to grow from $15.22 billion in 2025 to over $30.17 billion by 2033, driven by the critical need to connect diverse systems — CRMs, ERPs, databases, and SaaS applications — into unified architectures that AI systems can effectively leverage.

The Platform Advantage: Why Unified Beats Specialized

1. Data Coherence Drives AI Readiness

The most compelling argument for platform consolidation isn’t efficiency — it’s intelligence. Unified platforms create what we call “data coherence”: a single source of truth that enables sophisticated analytics and AI applications.

Consider GlobalCorp’s transformation to a unified platform approach. By consolidating their sales, service, and marketing operations onto a single platform, they achieved:

- Unified customer 360-degree views across all touchpoints

- Real-time reporting and dashboard capabilities that were impossible with siloed systems

- AI-ready data architecture that supports predictive analytics and automation

2. Future-Proofing Through Platform Evolution

Looking toward 2026, three out of every four business executives will need to adapt to new markets and industries using digital platforms. This adaptability comes from platform standardization, not tool proliferation.

Modern platforms are evolving rapidly to meet emerging needs. McKinsey’s Technology Trends Outlook 2025 identifies agentic AI and application-specific semiconductors as key emerging trends — capabilities that integrated platforms can adopt seamlessly while best-of-breed approaches struggle with compatibility.

When GlobalCorp adopted a “less than 20% customization” philosophy — focusing on configuration over customization — they achieved:

- Seamless system upgrades without breaking custom integrations

- Rapid deployment to new markets using proven templates

- Consistent user experience across global teams

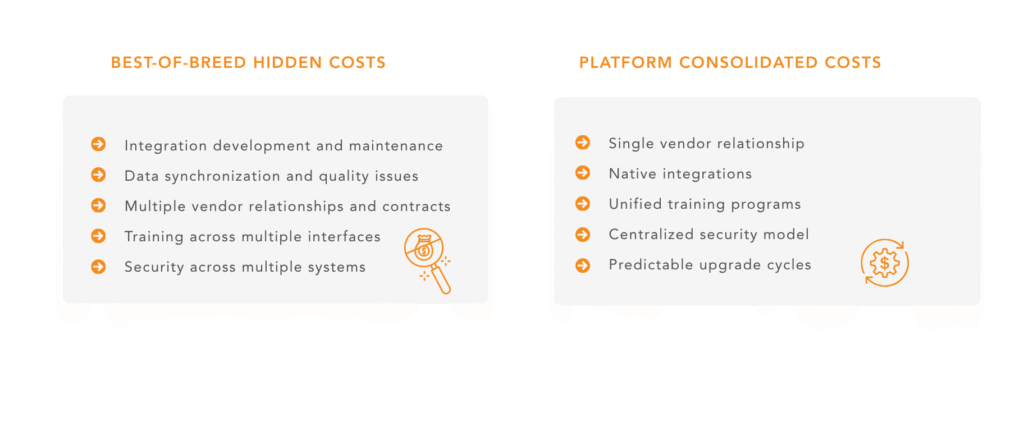

3. Total Cost of Ownership Reality Check

While best-of-breed tools might seem cost-effective individually, the total cost of ownership tells a different story:

The Multi-Cloud Platform Strategy: Having Your Cake and Eating It Too

The most sophisticated platform approach isn’t about choosing a single application — it’s about choosing a single ecosystem. Leading platforms like Salesforce now offer specialized clouds that maintain best-of-breed functionality while preserving platform benefits.

GlobalCorp’s multi-cloud expansion illustrates this perfectly. They started with basic Salesforce Sales cloud and service cloud functionality, then expanded to include:

- Manufacturing Cloud for industry-specific processes

- Partner and Customer Communities for ecosystem management

- Data Cloud for unified analytics

- Revenue Cloud Advanced for complex quote-to-cash processes

Each cloud maintains specialized functionality while sharing common data models, security frameworks, and user interfaces.

The AI and Automation Multiplier Effect

Perhaps the most compelling argument for platform consolidation is the multiplication effect it creates for AI and automation initiatives.

Real-Time Intelligence at Scale

When GlobalCorp migrated their 200+ global chat queues to their unified messaging platform, they didn’t just consolidate tools — they enabled intelligent routing across 18+ languages. This kind of sophisticated automation is only possible when systems share common data models and workflows.

Workflow Automation Without Integration Nightmares

Complex approval workflows, document generation, and contract management become exponentially easier on unified platforms. GlobalCorp’s quote-to-cash transformation handles:

- Hundreds of quoting locations

- Tens of millions of sellable products

- Multiple legacy ERP system integrations

- Complex global pricing rules

This level of complexity would be nearly impossible to manage across disparate best-of-breed systems.

The Strategic Framework: When to Consolidate vs. Specialize

Consolidate When:

- Data integration is critical to business operations

- User experience consistency impacts productivity

- AI and automation are strategic priorities

- Rapid scaling is required

- Total cost of ownership is a concern

Maintain Best-of-Breed When:

- Highly specialized functions have no platform equivalent

- Regulatory requirements demand specific tools

- Integration complexity is minimal

- The tool provides significant competitive advantage

Implementation Lessons: The GlobalCorp Playbook

GlobalCorp’s transformation offers a proven playbook for platform consolidation:

Phase 1: Foundation Building

- Standardize core processes before platform migration

- Establish data governance frameworks

- Design for 80/20 configuration vs. customization

Phase 2: Unified Operations

- Migrate high-impact, low-complexity functions first

- Establish single source of truth for customer data

- Train users on unified interfaces

Phase 3: Advanced Capabilities

- Layer on AI and automation using unified data

- Expand to specialized clouds within the platform

- Optimize workflows using native integration capabilities

Phase 4: Continuous Evolution

- Regular platform updates without breaking changes

- Ongoing process optimization using platform best practices

- Strategic expansion to new capabilities and markets

The Competitive Reality: Platform Leaders Are Pulling Ahead

90% of businesses are engaged in digital initiatives, but not all digital transformations are created equal. Organizations that have embraced platform consolidation are demonstrating measurable advantages:

- Faster time-to-market for new products and services

- Higher customer satisfaction through unified experiences

- Better financial performance through operational efficiency

- Greater agility in responding to market changes

The 2025-2026 Decision: Evolution or Revolution?

As we progress through 2025 toward 2026, the platform vs. best-of-breed debate has largely settled. The question isn’t whether platforms will dominate — it’s whether your organization will lead or follow this transformation.

Current market indicators show that companies embracing platform consolidation are pulling ahead. The Enterprise Software market is projected to grow by 6.18% through 2029, with cloud-based platforms reaching 60% market share in 2025. Organizations still managing fragmented tool stacks are finding themselves increasingly disadvantaged in AI adoption, operational efficiency, and competitive agility.

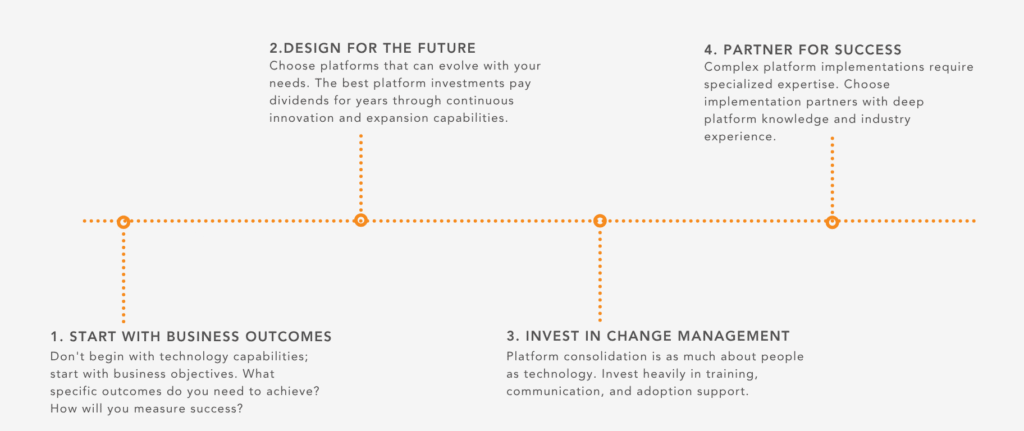

The Path Forward: Making Platform Consolidation Work

Success in platform consolidation requires more than technology selection — it demands strategic thinking:

The Platform Imperative

The evidence is clear: while best-of-breed approaches dominated the past decade, enterprise software consolidation is defining the next one. Organizations like GlobalCorp that embrace this shift are achieving operational efficiencies, customer experience improvements, and competitive advantages that simply aren’t possible with fragmented tool sets.

The question for enterprise leaders isn’t whether to pursue enterprise software consolidation — it’s how quickly you can make the transition while maintaining business continuity. In a world where digital transformation spending is projected to reach 2.5 trillion U.S. dollars annually, the organizations that get platform strategy right will capture disproportionate value.

The platform play isn’t just about better software — it’s about building a foundation for the intelligent, automated, customer-centric business of tomorrow. And tomorrow, as GlobalCorp learned, starts today.

Looking to evaluate platform consolidation for your organization? Consider conducting a comprehensive audit of your current tool stack, integration costs, and data fragmentation challenges. The investment in platform unification often pays for itself within the first year through operational efficiencies alone — before you even factor in the AI and automation capabilities that unified platforms enable.